dupage county sales tax rate 2020

This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also.

Winfield Illinois Il 60190 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

8158 Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475.

. DuPage County collects on average 171 of a propertys assessed. If no registered tax buyer bids on a parcel DuPage County as Trustee for all DuPage County taxing bodies becomes the buyer at an interest rate of 18. DuPage County IL Sales Tax Rate The current total local sales tax rate in DuPage County IL is 7000.

The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900. 119 Founders Pte S. The statutory fees cover.

Sales Tax Breakdown Lombard Details Lombard IL is in. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. Largest Recent Sales.

The Illinois state sales tax rate is currently. One of the reasons f 773-267-7500. The tax levies are adopted by each taxing districts board and.

As a note the average successful interest rate bid at the Tax Sale held in. 22 2022 900000. View details of paying with.

Tax buyers pay the tax amount due interest and a per parcel fee of 10400. The Dupage County sales tax rate is. There are no forfeitures unsold parcels.

Elmhurst IL Sales Tax Rate Elmhurst IL Sales Tax Rate The current total local sales tax rate in Elmhurst IL is 8000. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County. The December 2020 total local sales tax rate was also 8000.

This information would indicate that the average. With local taxes the total sales tax rate is between 6250 and 11000. 1337 rows 625 Average Sales Tax With Local.

The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special tax. Please be aware that the credit card service provider will charge a 210 convenience fee for the transaction. The sales tax jurisdiction name is Elgin.

1000 for Costs 400 for Sales Certificate 2000 for Tax Sale Indemnity Fund 1000 for. The December 2020 total local sales tax rate was also 7000. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due.

The 2018 United States Supreme Court decision in. Dupage County Illinois Sales Tax Rate 2022 Up to 105 Dupage County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dupage County does not. The current total local sales tax rate in Lombard IL is 8000.

The 2021 tax year assessed property value for DuPage County is 44058122920 762 residential and 238 commercial property. Easily manage tax compliance for the most complex states product types and scenarios. The Du Page County Illinois sales tax is 700 consisting of 625 Illinois state sales tax and 075 Du Page County local sales taxesThe local sales tax consists of a 075 special district.

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. No portion of that fee is retained by DuPage County. 3 2022 1775000.

Sales Tax Table Illinois IL Sales Tax Rates by City all The state sales tax rate in Illinois is 6250. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

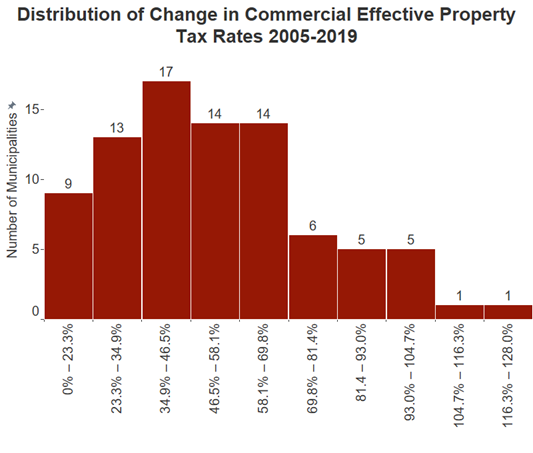

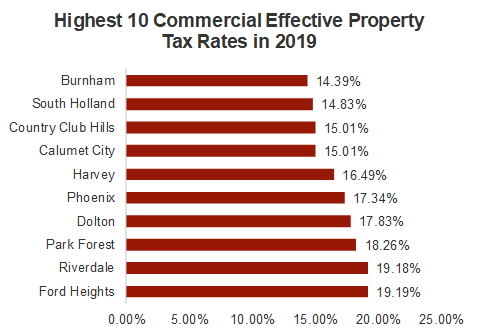

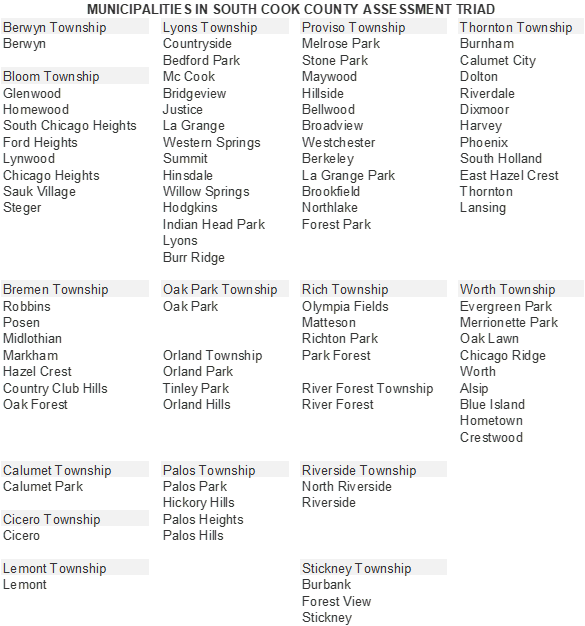

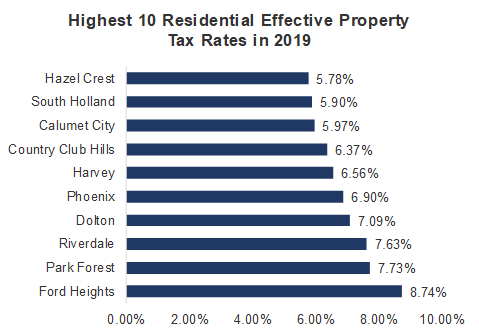

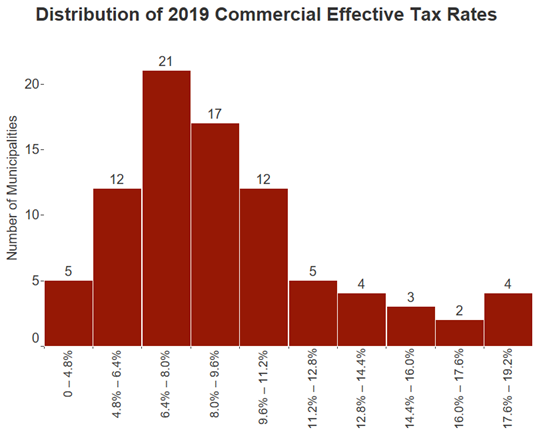

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Exploring The Data On Cook County Pretrial Electronic Monitoring Programs The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

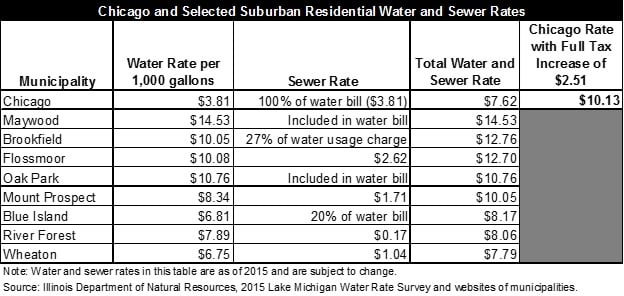

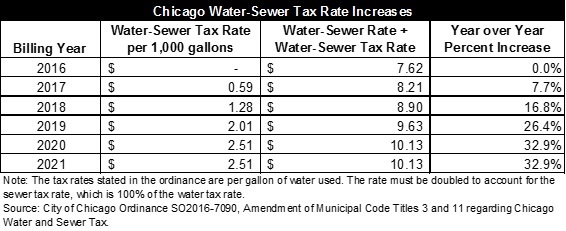

Chicago City Council Approves Water Sewer Tax For Municipal Employees Pension Fund The Civic Federation

News Flash Westmont Il Civicengage

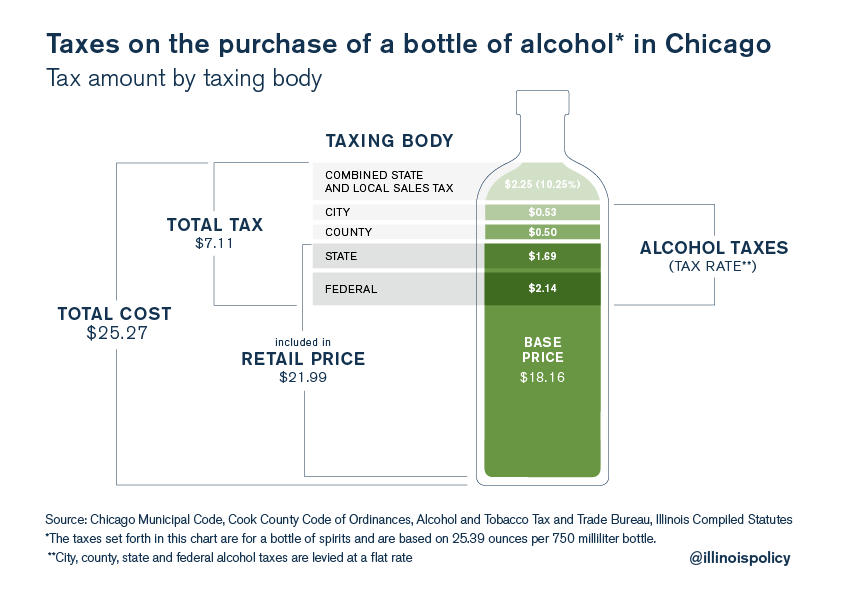

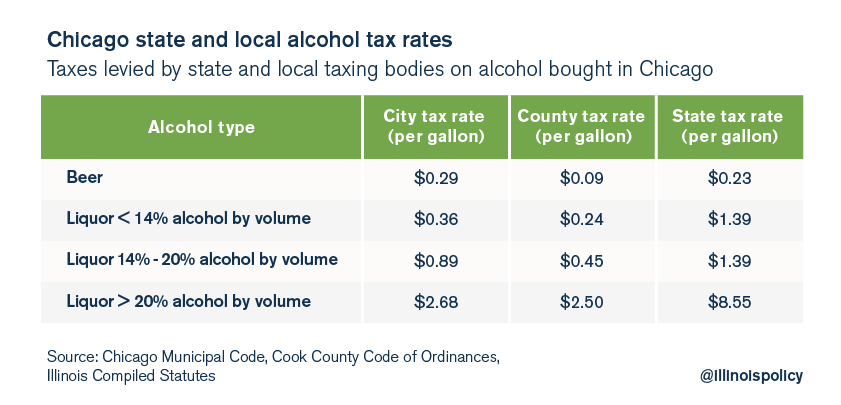

Chicago S Total Effective Tax Rate On Liquor Is 28

Exploring The Data On Cook County Pretrial Electronic Monitoring Programs The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

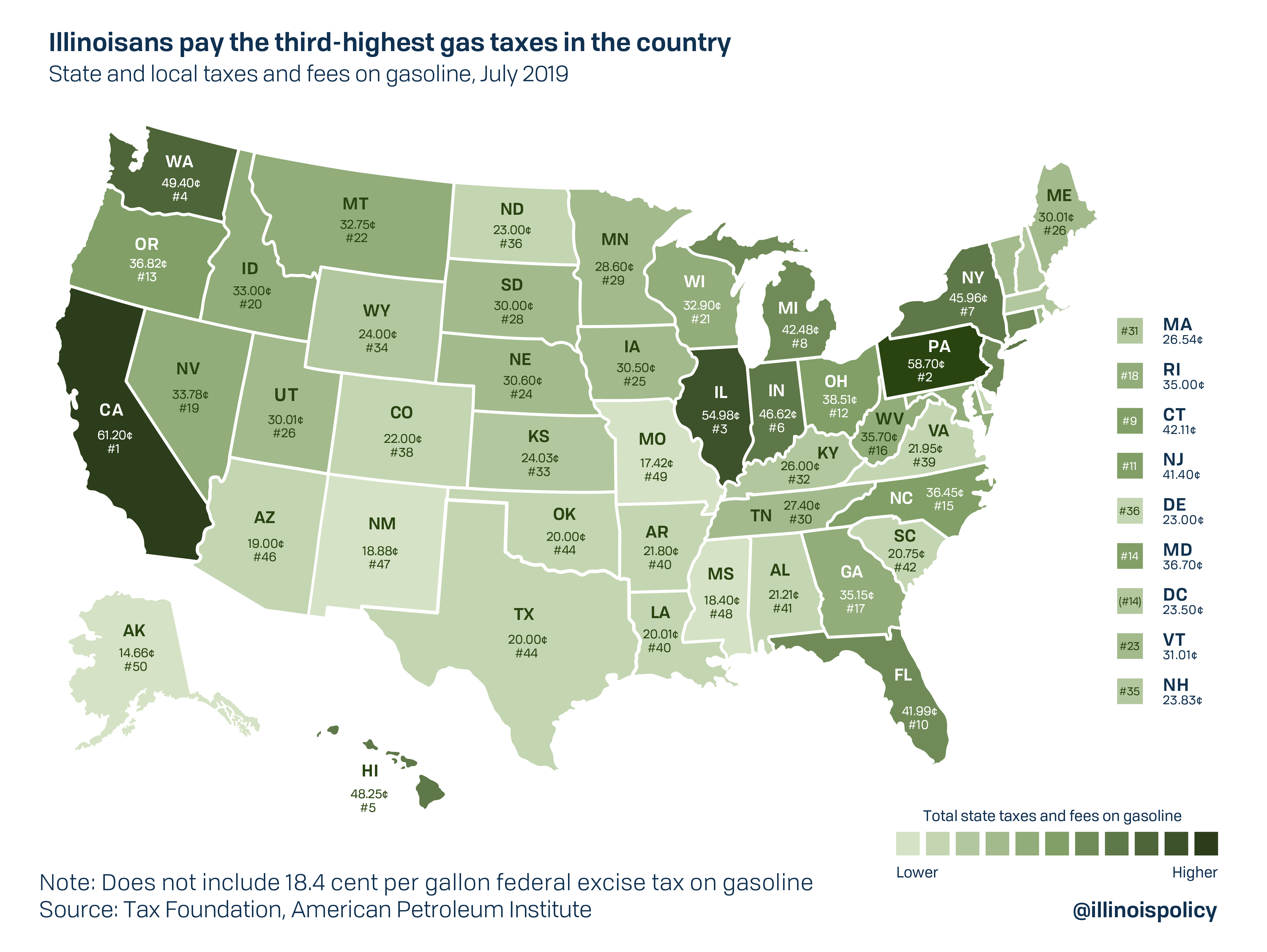

Will County Board Approves New 12m Gas Tax Atop Doubled State Tax

Chicago S Total Effective Tax Rate On Liquor Is 28

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Chicago City Council Approves Water Sewer Tax For Municipal Employees Pension Fund The Civic Federation

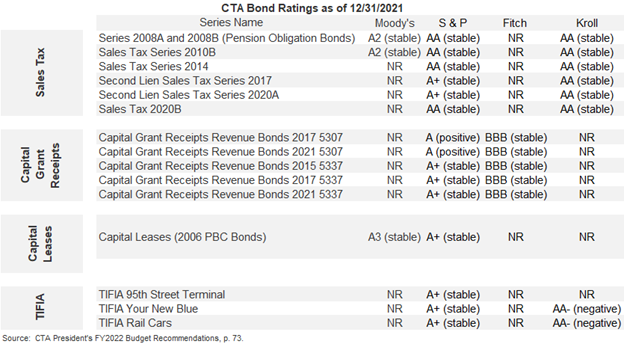

Cta Releases 3 5 Billion 5 Year Capital Plan The Civic Federation

Civic Federation Calls For Chicago Public Schools To Conduct Long Term Financial Planning Amid Personnel And Enrollment Trends And Temporary Federal Funding Relief The Civic Federation

Winfield Illinois Il 60190 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders